Neue klasse

November 6, 2025

Jay RameyBMW gears up for crucial EV launches in 2026, even as the EV industry faces several important tests.

The EV market is battling several major headwinds at the moment including an ongoing slump in demand, a still-fluid tariff landscape, the demise of the $7500 tax credit, and a new chip crisis, just to name a few.

While the industry at large has cancelled a number of new EVs, the dark clouds do not appear to have darkened BMW’s EV plans. The German maker is pressing ahead with 2026 the market debuts of two key Neue Klasse models.

Oliver Zipse, Chairman of the Board of Management of BMW AG, confirmed the timing of key EV launches on a conference call with reporters this week, painting a cautiously positive outlook for 2026.

“With the eighth generation of the 3 Series, we will bring the Neue Klasse and its technology clusters into the core of the BMW brand,” Zipse said. “Production of the i3 will get underway at our main plant in Munich in the second half of next year.”

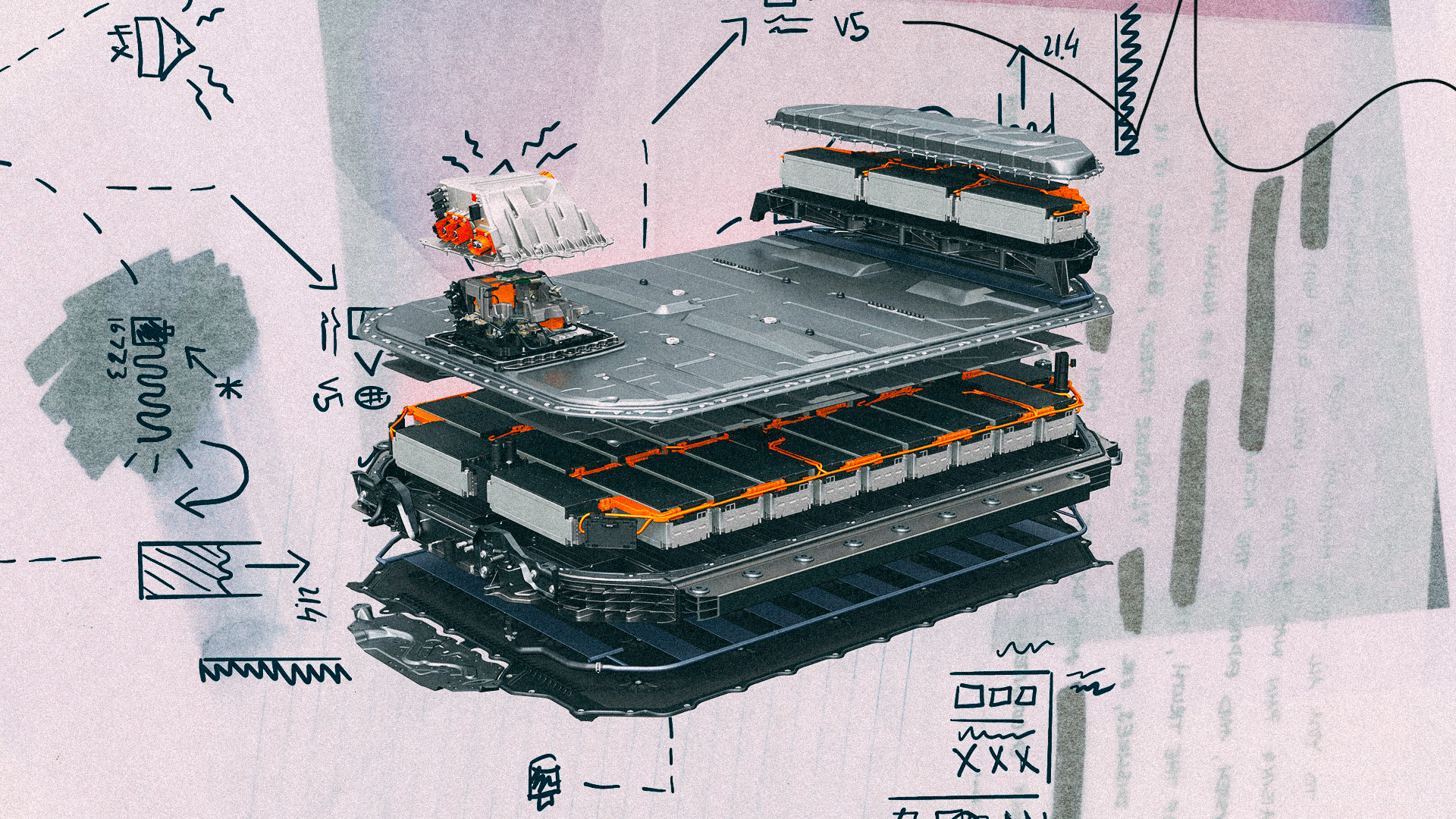

The next-gen i3, codenamed NA0, will be an EV-only sedan promising a 30% increase in range thanks to new battery technology, as well as a quick-charging 800-volt architecture. The sedan is expected to have a minimalist interior, with a number of themes previewed by the Vision Neue Klasse concept in 2023.

The i3 sedan’s iX3 SUV sibling will be another important launch for BMW in the coming months, with production having already kicked off at a new plant in Debrecen, Hungary.

“We have started taking customer orders for the car, which have exceeded our expectations,” Zipse said. “Just looking at Europe, we see orders already extend several months into 2026 already.”

The iX3 is expected to offer a range of over 497 miles, or 800 kilometers in the WLTP cycle, while featuring an 800-volt architecture that will permit charging speeds of up to 400 kW. Landing in a popular SUV segment size, the model is slated to be one of the key Neue Klasse launches of the year, with Europe expected to be the main driver of iX3 sales.

Still, Zipse noted some persistent challenges facing the BMW Group, including the tariff situation with the US, a shifting geopolitical landscape, and a sudden surge in competition from Chinese brands.

“Despite the challenging market dynamics in China, our overall global sales posted year-on-year growth of 8.7% in the third quarter; excluding China, it was 12.2%,” Zipse said, noting that sales in the US grew by 9.5% year-on-year, while seeing a similar bump of 8.6% in Europe.

“These strong results helped compensate for the development in China,” Zipse added.

Speaking of China, Zipse also pointed out that BMW is taking a special approach to manufacturing for the local market, which has evolved into a distinct product landscape in record time.

“The Neue Klasse products we will launch in China are developed together with our local engineering teams and Chinese partners – in the market, for the market,” Zipse said. “Our Neue Klasse architecture allows to integrate local tech stacks from leading Chinese tech players into our own ecosystem.”

Pressured by surging Chinese brands with EVs in their lineups, the luxury end of the market in China has been brutal for Mercedes, BMW and other European brands, even with local production.

Despite seeing BMW Group sales of BEVs increase by 10% globally in the first nine months of the year, with BEVs eclipsing a quarter of total sales in Europe alone, sales in China continued their slide for BMW, dropping by 11% in the third quarter following similar drops in the first half of the year.

Perhaps a greater challenge than correcting sales in China alone will be the competition from Chinese EV brands in Europe in the coming years — a reality that would have been difficult to picture a short few years ago.

While not backing away from longer-term EV plans, Zipse voiced some skepticism over EU climate targets for 2030 and 2035.

“Setting an end date to a specific, successful technology will lead to a massive shrinking of the industry as a whole,” Zipse said. “It will harm European industry and also create dependencies that are unwise in the current geopolitical dynamic.”

Even if it stays clear of various unfolding crises, 2026 is set to be a make-or-break year for BMW’s EV strategy, with the i3 and iX3 set to test the waters at a precarious time for Europe’s auto industry.

Recent Posts

All PostsAlloy

January 30, 2026

Peter Hughes

January 29, 2026

January 29, 2026

Leave a Reply