Tough Quarter

Amid dismal financial results, U.S. tariffs might not be Porsche’s main predicament.

Record deliveries in North America and a few other markets might sound like the recipe for a successful quarter for Porsche. But despite some positive standalone indicators, including electrified vehicles eclipsing a 50% share of sales in Europe, Porsche posted some truly sobering quarterly results.

First, the bad news, before we get to the worse news.

The German sports car maker saw a 99% drop in operating profit over the past three months, tumbling from $4.68 billion since the start of the year to just $46 million.

Porsche AG also saw an operating loss of $1.1 billion, in stark contrast to a profit of $1.14 billion seen by this point last year.

Meanwhile, the group’s operating return (profit per dollar on sales) dropped from 14.1% last year to just 0.2%.

Porsche cited many culprits for the apocalyptic numbers, including U.S. import tariffs along with what it described as “challenging market conditions in China,” as well as scaling back EV production in favor of hybrids as demand cools rapidly from its early 2020s high.

“This year’s results reflect the impact of our strategic realignment,”

“This year’s results reflect the impact of our strategic realignment,” said Porsche CFO Dr. Jochen Breckner. “We are consciously accepting temporarily weaker financial figures in order to strengthen Porsche’s resilience and profitability in the long term.”

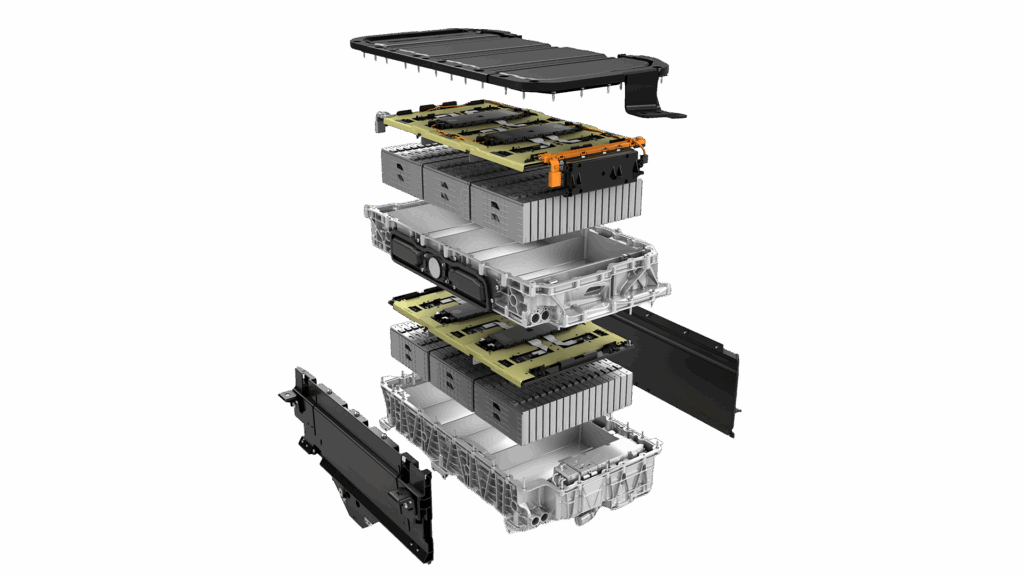

In addition to these factors, the automaker cited its own internal organizational changes for the worrying results, in addition to “one-off” events tied to its battery business, which resulted in expenses of $3.1 billion.

“We expect 2025 to be the trough that precedes a noticeable improvement for Porsche from 2026 onwards,” Dr. Breckner added, hinting at a rebound that could materialize down the road.

Just how much optimism is warranted remains to be seen as the automaker faces labor negotiations and other possible moves that could result in layoffs in the near term. Porsche refers to upcoming negotiations as the Future Package, with Dr. Breckner summing up Porsche’s longer-term prospects with a chilling statement.

“We have to assume that the general market conditions will not improve in the foreseeable future,” Breckner said.

But just how much of the current carnage could be attributed to the U.S. tariffs?

The automaker cited hikes in costs “within the mid three-digit million range,” painting a picture that could remain static for some time, with 15% import tariffs expected to stay a while.

Porsche will face another challenge that isn’t tied to U.S. tariffs and the firm spent little time addressing it.

Stuttgart’s market share in China is eroding in the face of new competition, though it’s hardly alone in this dilemma. Like other European luxury car makers, Porsche is under ever-increasing pressure from new domestic brands, luxury and otherwise, with no easy solutions in sight.

In the past few months Porsche CEO Oliver Blume and other CEOs hinted that European automakers’ downward trend in China is likely irreversible, and that the recently thriving luxury car market had disappeared beneath a wave of more affordable domestic EVs. Porsche’s sales in the Middle Kingdom dropped by about 26% in the first nine months of the year, totaling 32,195 vehicles out of 212,509 worldwide.

Even amid the decline, this represents 15% of Porsche’s total worldwide sales over the first nine months of 2025. China is not an insignificant market for the company.

“The company assumes that the strategic realignment envisaged in the cycle plan will only partially compensate these additional burdens,” the automaker recently admitted, acknowledging the limitations of its turnaround strategy.

Porsche’s moves at home—which appear limited to reducing headcount and pushing back its EV plans—won’t address any of the headwinds it faces in China. And they might not move the needle in Europe, either, where Chinese automakers have been steadily gaining ground.

If there are any bright spots in Porsche’s report, they likely include how far ahead of other European automakers Porsche happens to be when it comes to its EV and PHEV product mix in Europe and North America. In the first nine months of the year EVs accounted for 23.1% of vehicles delivered, while 12.1% were PHEVs, with Europe alone seeing electrified models representing 56% of deliveries. These numbers are ahead of most of its peers, who are likewise busy dialing down their own EV plans in favor of PHEVs.

Porsche does not have a solution for its China problem, nor does it foresee an end to the painful U.S. tariffs. It will have to optimize its strategies in more promising markets to stop the bleeding.

Alloy Art Direction: Isabella Pino

Recent Posts

All PostsMarch 6, 2026

March 6, 2026

March 5, 2026

Leave a Reply