Electric Dreams

December 23, 2025

Jay RameyVW is expected to embrace EV powertrains in smaller models, but this could leave some countries out in the cold.

Less than two weeks ago the European Union altered its 2035 emissions targets, permitting a small percentage of hybrids and internal-combustion models to remain on sale beyond the target date. The long-expected move, lobbied for by Mercedes-Benz and others, was ultimately a half-victory of sorts for European automakers, which will still face the mandate of achieving a tailpipe emissions reduction of 90% by 2035 instead of the earlier 100%. The remaining 10% will be addressed, among other things, by rather exotic means including e-fuels, biofuels, and low-carbon “green steel”, all of which exist on a boutique scale at the moment.

Needless to say, there are some practical gaps remaining in this roadmap, which could yet be revised downward in the coming years based on actual market realities.

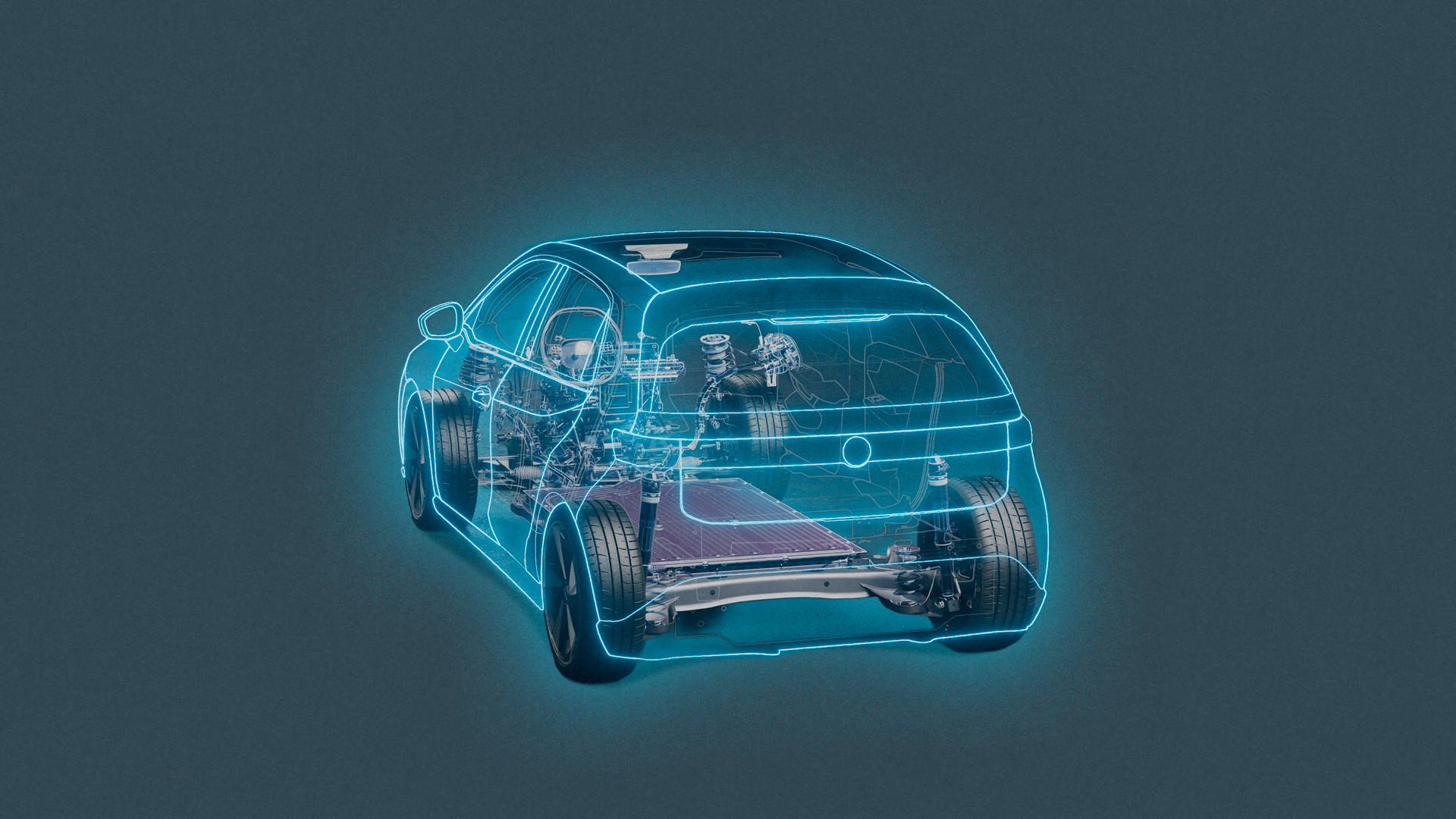

But VW is already preparing for a future in which small cars will be mostly electric.

In a recent interview with Auto Motor und Sport, VW brand chief Thomas Schäfer issued comments suggesting that new small cars from the brand will increasingly rely on EV powertrains in the future.

“Offering new gasoline-powered models in the Polo class and below makes no sense in light of future emissions regulations,” Schäfer said.

Exhibit A in this new strategy will be the front-wheel drive ID. Polo, set to go on sale next year, which will be offered with two battery options and four power outputs, promising up to 280 miles of range. A relatively small 37-kWh LFP battery will power the base model, while other versions will see 52-kWh NMC (nickel manganese cobalt) batteries. There will even be room for a GTI model in the Polo range promising 226 hp, while the base model will serve up just 116 hp.

“With the ID. Polo, Volkswagen is focusing on familiar strengths: intuitive operation, functionality, quality and affordability,” Volkswagen said.

“The result is a compact electric model offering more space and precise driving characteristics on the level of the next higher class of vehicle. In addition, it is the first model in the electric ID. family to bear the established Volkswagen name Polo,” the automaker added.

But the ID. Polo will still be far from the smallest and most affordable model in the VW lineup, with a starting price of €25,000, or about $30,000. Ideally, VW will need a sub-Polo EV to compete with Chinese automakers that have made significant gains in Europe seemingly overnight.

To address imports from China, VW plans to launch a production version of the ID. Every1 hatch in 2027, aiming for a starting price of €20,000, or about $23,500.

The 152.8-inch ID. Every1, if it keeps that nameplate and length, will be replacing the VW e-Up! in the automaker’s lineup. But it won’t be setting any range records, with an expected range of just 155 miles.

VW won’t exactly be the first to reach the sub-$25,000 price level, as the updated Dacia Spring is going on sale in the UK right now with a starting price of $16,500 after incentives, offering a range of 140 miles in the WLTP cycle. So there is still plenty of room below the planned ID.Every1 in price, with Chinese automakers expected to continue to making gains in entry level EV segments.

And the ID.Every1, even in production form, may not end up at the lower end of the size spectrum for long. Days ago the EU further solidified plans for a kei-style minicar category that automakers have lobbied for, anticipating further gains by Chinese automakers.

“Low-cost entry-level mobility in the electric era will be one of the cornerstones of the brand’s future plan,” the automaker said earlier this year.

But just how profitable the ID. Polo and ID. Every1 will be for VW remains to be seen.

EV adoption rates remain slow in eastern Europe. With a gradual turn to EV powertrains in its smaller models, VW could be giving up a leading position in a number of countries just east and south of Germany where gas and diesel models still rule the roads. More distant markets like South America or Africa are on their own timetables regarding EVs as well, ones which may not match up with Wolfsburg’s 2035 plans.

Also absent in these plans is any mention of the US market, perhaps for understandable reasons, even though small and affordable cars were once Volkswagen’s bread and butter. In recent decades VW has largely abandoned most of its compact cars when it comes to the US and Canada in favor of ever-larger crossovers.

It remains to be seen just how successful Wolfsburg will be in embracing smaller car segments in the coming years, given the limited profit margins that drove VW upmarket not long ago, and amid business pressures that have already set into motion one factory closure in recent days.

Recent Posts

All PostsMarch 2, 2026

February 27, 2026

February 26, 2026

Leave a Reply