Roborace

December 8, 2025

Jay RameyUber and Lyft are seemingly in a race to field robotaxi fleets, even as profitability remains out of sight.

Now that robotaxi tech is approaching some semblance of reliability, albeit in limited, geofenced areas and still with some traffic snafus, traditional ride-hailing apps, still in search of a workable business model after all these years, are not only giving it a second look, but are actively jockeying for position in multiple metro areas in the US and Europe.

Uber, which has been salivating at robotaxi tech for some time, has struck partnerships with almost two dozen autonomous developers and operators including Nuro, Lucid, Volkswagen, Momenta, Waymo and others, some in the freight sphere.

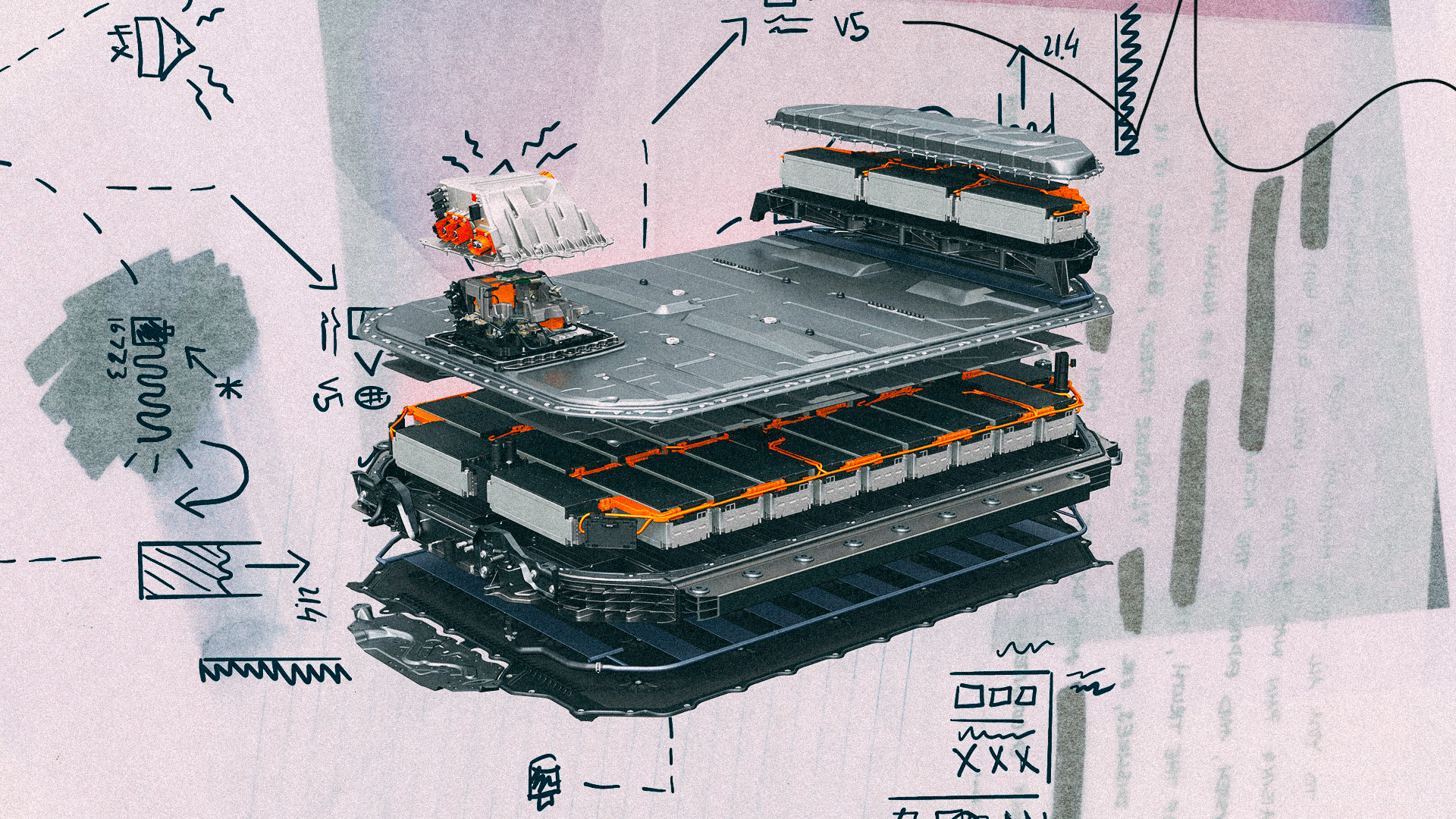

One of the latest Uber partners, Austin-based Avride, launched a robotaxi service this week in Dallas with SAE Level 4 cars based on the Hyundai Ioniq 5.

“At launch, the service will be available throughout 9 square miles of Dallas – from Downtown to Uptown to Turtle Creek to Deep Ellum – with plans to expand the operating territory in the future,” Uber said.

App users wishing to try the Avride robotaxis could be matched with one if they request an UberX, Uber Comfort, or an Uber Comfort Electric ride, the company said, though it did not specify how many cars were part of this initial Dallas fleet, which will still have human safety monitors behind the wheel for now.

What’s more, Uber and Lyft now appear to be in a race to embrace robotaxi tech, contributing their app user bases to autonomous developers and operators while at times taking on some of the tasks of servicing the fleets themselves.

Lyft has struck partnerships with May Mobility, Mobileye, and once again Waymo, while seeking to gain a foothold in Europe in a partnership with China’s Baidu. All of these efforts have been undertaken very recently.

The two ride-hailing giants now appear to be betting that some fleets will experience more success and scalability than others, while still postponing the nagging issue of robotaxi profitability.

But while the passenger experiences might ultimately be similar, the economics behind these operations for the apps themselves are very different.

Instead of relying on gig-economy independent contractors typically using personally owned or leased vehicles, which they service and fuel, robotaxi fleets have to be owned and serviced by companies while also requiring a high-tech remote command center to watch over the fleets in real time. Staff also has to be hired or contracted to clean and charge the cars, imposing further operating costs.

In effect, the apps are trading the subcontractor business model for something far more cost- and labor-intensive that now requires plenty of paid employees, fleet service contractors, and physical footprints, ranging from EV charging lots to operations centers.

One problem is that even the old-fashioned human gig-worker business model was deeply unprofitable for a long time, with Uber losing billions of dollars annually for a decade and a half in the 2010s and 2020s without owning the actual cars, posting profitable quarters only recently.

Likewise, Lyft has posted losses for several years, seeing its first profitable quarter in 2024.

A silver lining of this emerging robotaxi ecosystem, if there is one, is that it is steadily creating more jobs in servicing the robotaxis themselves, at times higher-paid ones as they require advanced IT degrees to watch over and troubleshoot misbehaving cars remotely.

It remains to be seen whether robotaxi tech, by now having seen billions shoveled into its own technical development for the past decade, will be able to pull the ride-hailing apps out of their own financial quicksands at some point in the future. But that point does not appear particularly close.

Recent Posts

All PostsAlloy

January 30, 2026

Peter Hughes

January 29, 2026

January 29, 2026

Leave a Reply