Resto

January 26, 2026

Brett Berk

What’s the business case, if any, for this slew of limited-edition seven-figure restomods?

The announcements in my in-box, and the automotive coverage, seem to arrive with startling regularity: A new, unproven company will be restoring, and resolutely upgrading, a miniscule number of a beloved, obscure, and/or forgotten model, and will be charging a few lucky customers six or seven figures (plus the cost of the donor car) for the privilege. The chosen nameplates— Lamborghini Diablo, Lotus Esprit, Acura NSX, and Lancia Delta Integrale among them—favor exclusive supercars built in the final decades of the 20th century, though some date from earlier and/or aren’t exactly exclusive or super, the Fox Body Ford Mustang and Volvo P1800 come to mind.

Though I prefer my vintage vehicles unmodified, I have no opposition to restomods. I believe that people should be able to enjoy their old cars however they please, and if that includes being able to drive them without constant concern for catching fire or being stranded, that’s their prerogative. I do wonder about the viability of these initiatives. Like, how do they make money? Or is that the point?

Interest is not the issue. In an era of increasingly perfect electrified hypercars, discerning buyers are looking for something different—something more visceral, and distinctive. “The idea is really to give back to the driver that raw, analog emotion. Something distinguished, with sophistication,” says Andrea Colombo, board member at Eccentrica, which is producing 19 seven-figure restorations of the original Lamborghini Diablo coupe. “And when the big OEMs like Lamborghini and Ferrari need to produce more cars to be sustainable and to give the profit the shareholders want, they have to produce even their ultimate cars like the F80 in 799 units. That is not what I call exclusive. I think below 50 is something that makes clear positioning in scarcity.”

But the process of re-engineering an already complex vehicle, and adding more power and usability, necessitates a thorough reworking of nearly every system, including engine, transmission, brake, suspension, cooling, and body, not to mention upgrading creature comforts and onboard technology. “The material to produce one Eccentrica is highly costly—3500 components in the car are heavily reengineered,” says Colombo. “So it means that the cost of doing the product is high. And the margin we take from the cost needs to pay for all the current expenses plus all the engineering cost.”

Amortizing those outlays seems nearly impossible with a run of just 19 cars. And even if the brand chooses to extend that from its initial series of Diablo coupes to something like Roadsters or high performance VT and SV models, there just weren’t that many Diablos made—just 2900 over an 11-year run. An even smaller pool of those is lying around waiting, or wanting, to sacrifice their VINs.

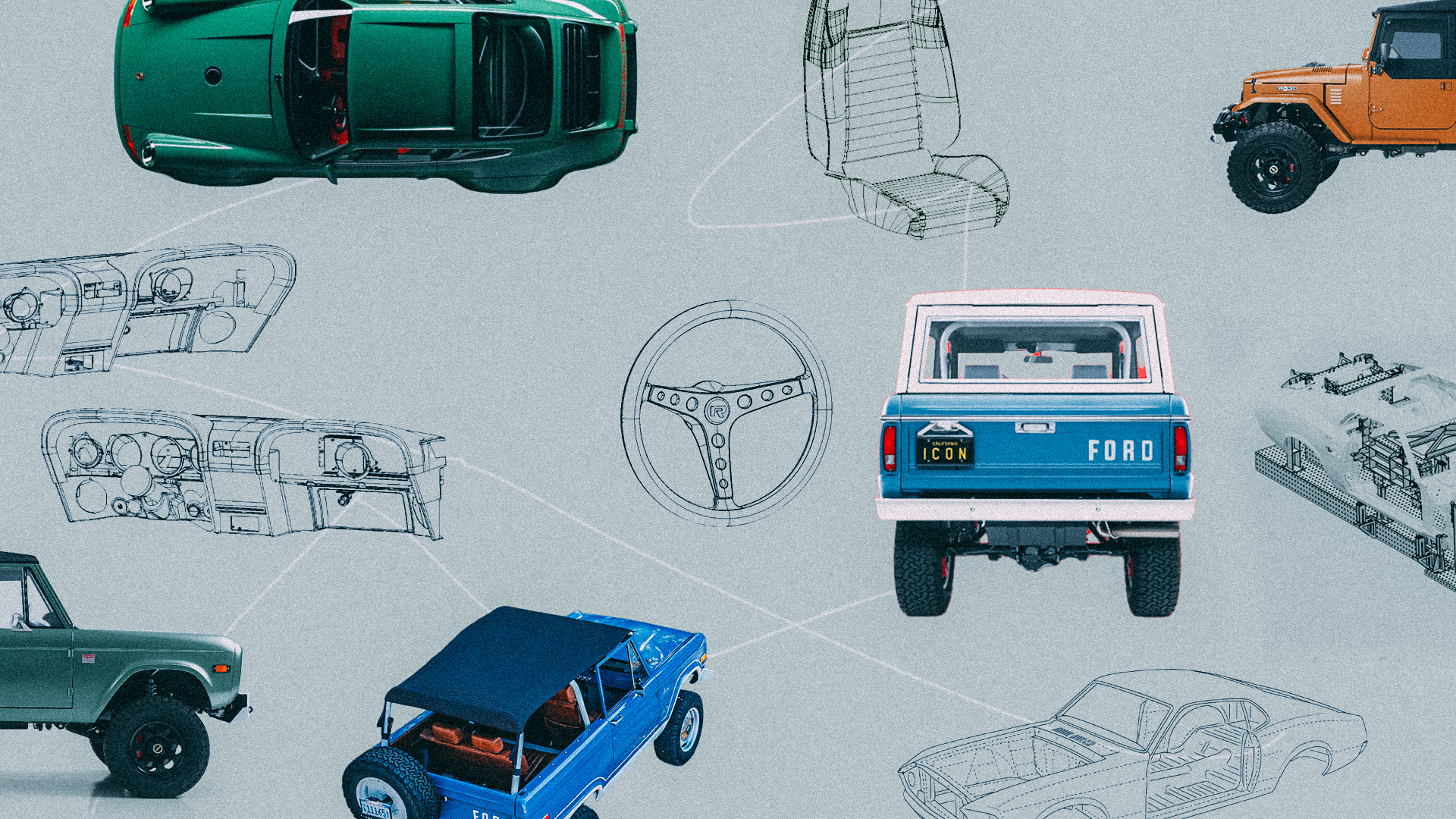

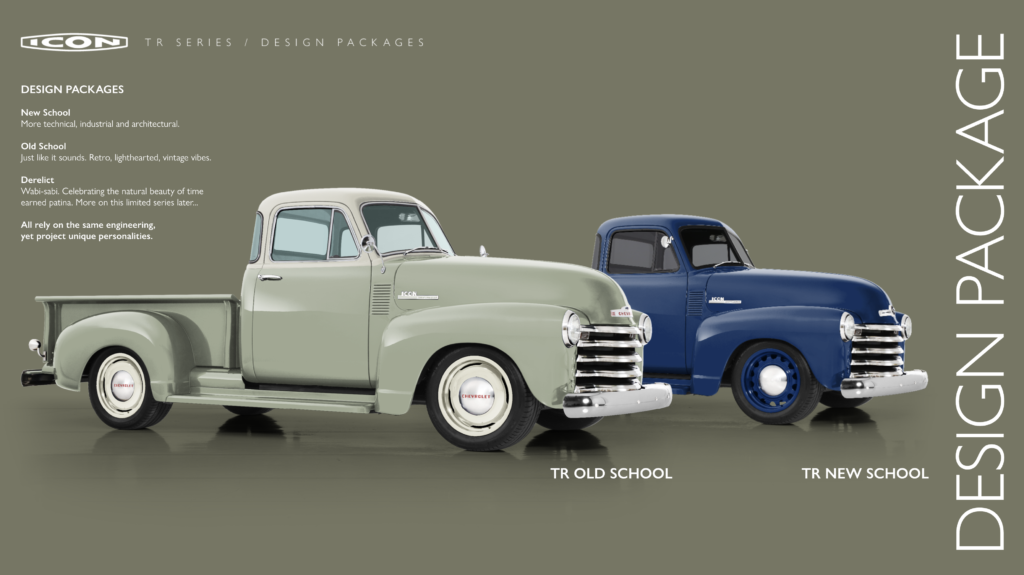

“I’ve tried to do the math of doing really short runs myself. But given the engineering cost to do it, I don’t see the P-and-L working out,” says Jonathan Ward, founder of the highly successful, and profitable, restomod company ICON, which has sold hundreds of meticulously revamped $300,000 – $500,000 vintage Ford Broncos and Toyota Land Cruisers. “I have a hard time seeing that working, especially when there’s companies in our space charging seven digits a vehicle and they’re still hemorrhaging money.”

The core problem isn’t demand. Or ideas. “Less and less people have more and more of the money,” Ward says. “And a lot of people think, ‘Oh, that looks easy, and I love cars.’” It’s repeatability. “Getting the vision out of your head, into CAD, and into reality, that’s just step one. Then it’s ‘Oh, shit. How do I repeat that efficiently? Find the supplier base that will deliver the quality at the volume we can offer them, and then developing replicable production engineering to run a proper business.” Only a few companies have really been able to do this successfully: ICON, Singer, and Revology among them.

Ward only sees a couple ways in which such a limited restomod setup could function as a viable business. The first is as a kind of branded collaboration. “Say you’re leveraging a carbon autoclave company that wants more visibility to consumers by getting named in a project, and that helps subsidize the cost,” he says. This might be an incentive for the inclusion of name brand suppliers like Pininfarina’s involvement in JAS Motorsports’ aforementioned first-gen Acura NSX initiative.

The other, is as a pet project. “A lot of these start with an extremely wealthy company or individual who says, ‘Fuck it. I want one.’ And then they’ll allow a very short additional run to be built,” he says. “They’ll say, ‘If I can break even on the project and have my one dream car, and there’s four, or fourteen, more out in the world, that’s fine.’” This may be the case for Eccentrica, which began, according to Colombo, “with a founder who is a Lamborghini collector, and wanted to improve on the Diablo.” Such enterprises could even be used to reduce a private or holding company’s liabilities. “If it’s a division of a larger entity that’s paying out so much in taxes, they could take the loss, and still get something out of it,” Ward says.

Where does all of this lead us? Well, OEMs are already attempting to capitalize on this market by creating ever more unobtainable, extremely limited cars for their wealthiest clients. “The reason mainstream manufacturers are doing more one-offs and few-offs themselves is because there is that market. And they can see that from these external restomod brands,” says Michael Dean, global head of automotive research at Bloomberg. He cites as example Aston’s recent run of DB5 continuation cars.

What seems likely is a culling of these companies, as they figure out that sustainable profits just can’t be derived from such capital-intensive investments. “The market is oversaturated, and there’s a lot of promises that aren’t really being delivered in the product,” Ward says. “So I’m kind of ready for that next phase of consolidation.”

Another option would be a deepening of true coachbuilding, with artisans taking on passion projects solely for extremely well-off individuals. “I’ve expected a revival of traditional coach-built houses,” Ward says. “Giving up on the dream of scale—paring back, running skeleton, leaving your ego at the door, and building what you love. It’s not going to go public, but it’s creatively fulfilling if you structure it right.”

Recent Posts

All PostsJanuary 27, 2026

January 27, 2026

January 26, 2026

Leave a Reply