Solid-State

December 31, 2025

Jay RameyDespite recent on-road tests, "game-changing" solid-state batteries are still years away and will likely lead to a more stratified EV market.

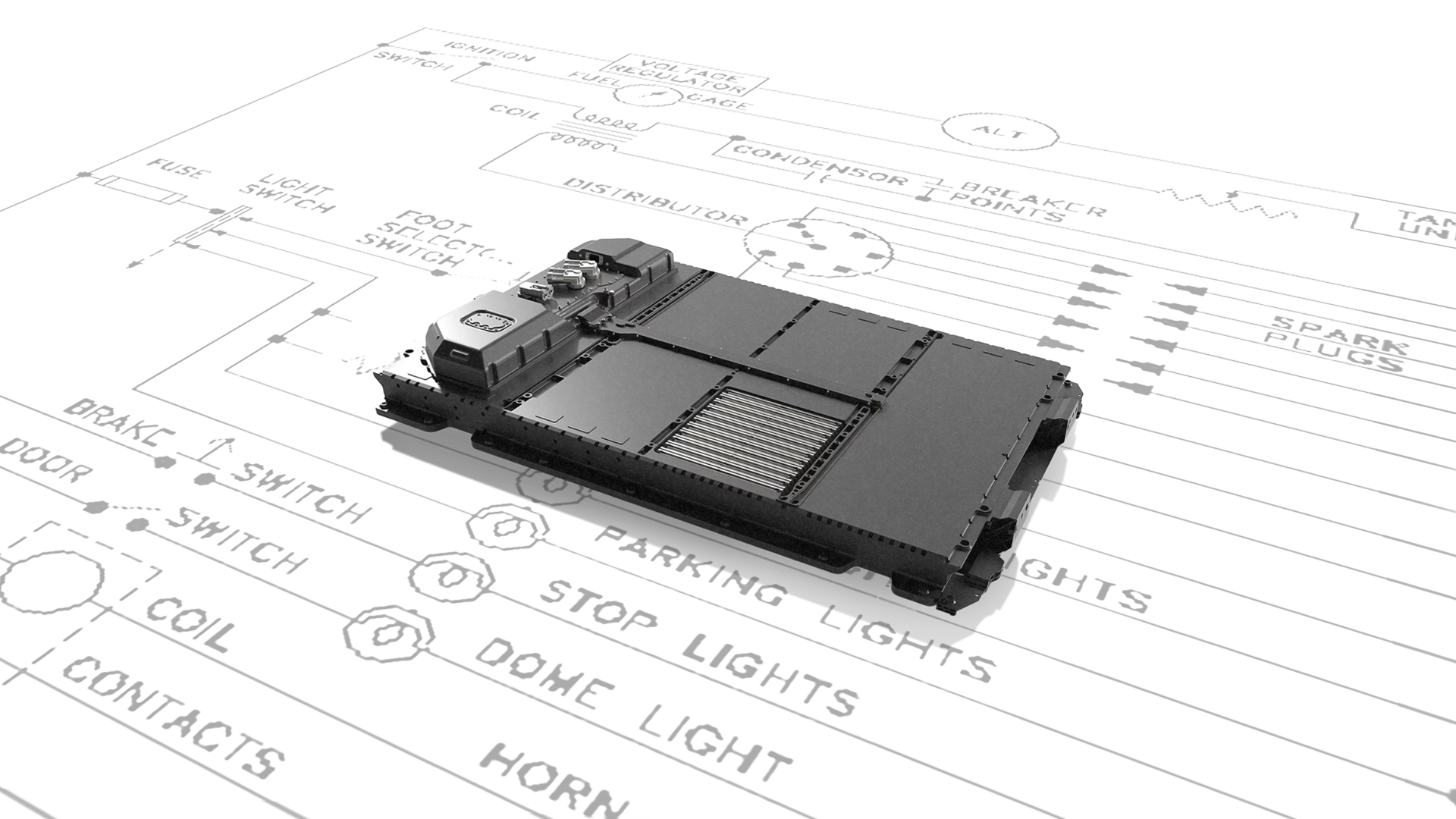

Solid-state batteries have always been just over the next hill, with a number of developers touting compositions allegedly on the verge of commercial viability for the past decade. The driving force behind the hype has been the promise the solid-state designs will offer greater energy density and thermal safety, faster charging times, longer lifespans, lower weight, and ultimately, longer ranges for EVs.

This doesn’t change the fact that in 2025 there isn’t a single all-solid-state battery (ASSB) in a mass-produced EV.

But despite delays in the crucial transition from the lab to small-scale production, there have been some positive movements over the past couple of years that has given a few automakers some cause for optimism.

Boston-based solid-state developer Factorial, backed by Mercedes-Benz and Stellantis, among others, has been testing its pouch-type cells in EV prototypes for the past year. Recent on-road tests this fall culminated in an EQS sedan covering 749 miles on a single charge, driving from Stuttgart, Germany, to Malmö, Sweden. And the modified sedan still had 85 miles of range remaining upon arrival.

That’s almost double the standard EQS 450+ sedan’s EPA rating of 390 miles. Among other things, this record also eclipsed the 747-mile record of the Vision EQXX prototype.

“The solid-state battery is a true gamechanger for electric mobility,” said Markus Schäfer, Member of the Board of Management of Mercedes‑Benz Group AG, Chief Technology Officer, Development & Procurement. “With the successful long-distance drive of the EQS, we show that this technology delivers not only in the lab but also on the road,”

However, the transition from on-road tests to mass production still lies ahead, with Mercedes-Benz and Stellantis so far steering away from concrete timetables while hedging their predictions for commercialization.

But will solid-state designs actually be the of game-changer in the EV market, as some automakers and developers hope?

On the question of commercialization, Factorial CEO Siyu Huang has hinted in recent months that it could take three to four years after the planned 2026 initial launch to fully scale up solid-state production, placing it into the 2029-2030 time frame.

More importantly, the debut of solid-state batteries by themselves won’t mean that all EV batteries will be solid-state designs by that year.

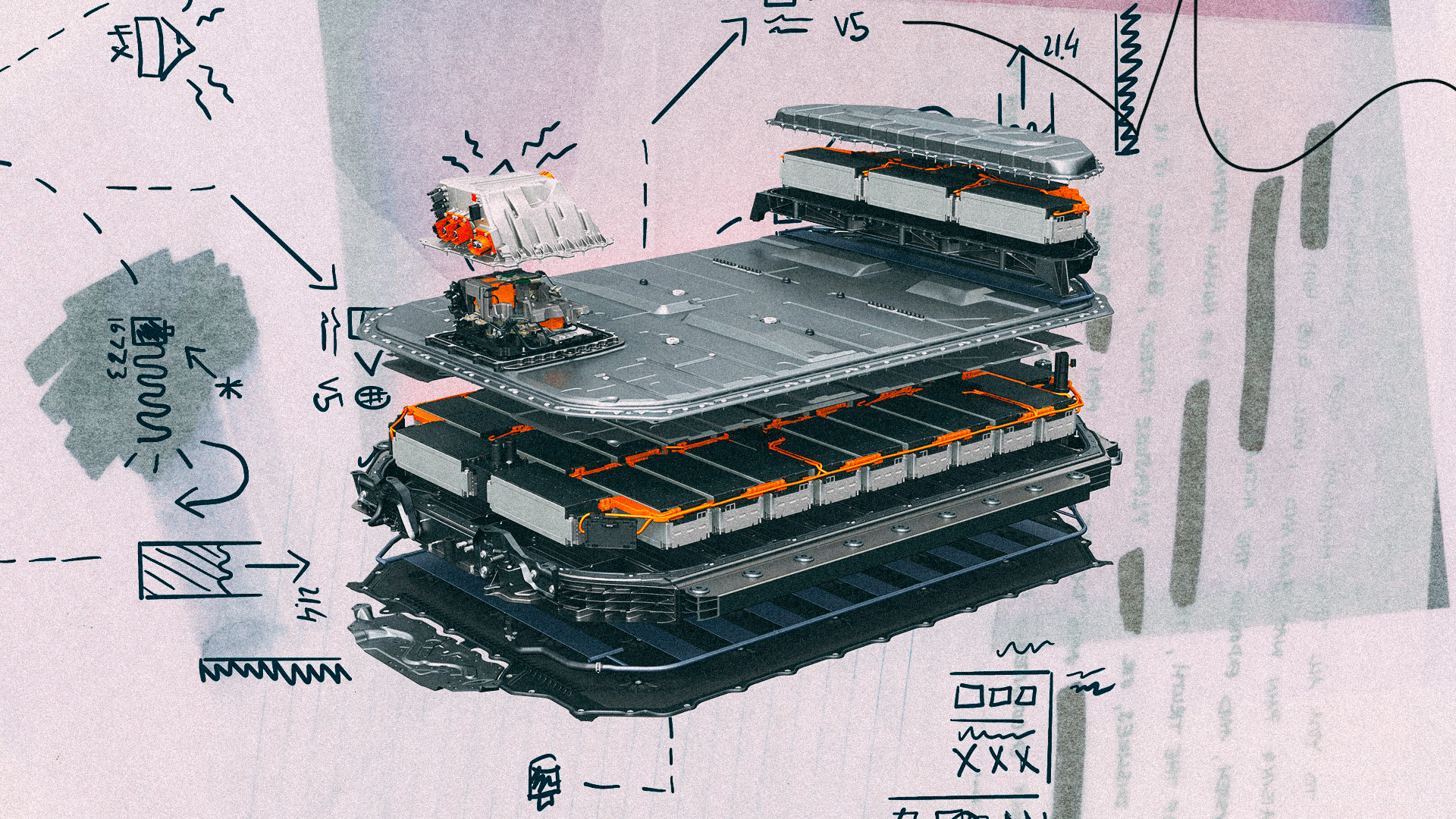

BMW has been testing solid-state designs from developer Solid Power, having advanced to the pack design stage that still poses some engineering challenges, such as managing cell expansion. That’s because Solid Power’s prismatic cells with sulfide-based electrolytes expand and contract depending on the state of charge.

“Further development steps are required to implement ASSB [all-solid-state battery] technology in a competitive overall storage system,” Solid Power indicated earlier this year.

Commercializing solid-state designs, therefore, is not solely a question of battery cells themselves as seen at the lab level, but also a question of successfully integrating them into battery packs that have novel engineering requirements of their own.

BMW has been testing the solid-state cells in the i7 sedan, but they’re perhaps unlikely to make it into the production version of this generation of the model. This pushes their earliest production debut into the 2030s as well.

Toyota, seen for a long-time as an EV skeptic, has been working on solid-state compositions with Sumitomo Metal Mining since 2021, and now expects a market launch of EVs with all-solid-state packs in the 2027-2028 time frame, as the automaker revealed earlier this fall. If this timing holds, this could effectively place it at the head of the solid-state race.

If there is one further caveat to solid-state battery timelines, it’s the production costs of the early designs themselves. The slow ramp-up hinted by a number of developers suggests that the first solid-state packs will debut in high-priced EVs first. So the changeover to solid-state designs won’t be an overnight event: Traditional lithium-ion, lithium iron phosphate (LFP) and other compositions will remain in production for some time, well into the 2030s.

In effect, if all goes according to plan, we could see a multi-tiered battery market, with solid-state designs at the top, higher-performing lithium-ion designs including nickel manganese cobalt (NMC), in the middle, and less expensive and less energy-dense LFP battery packs at the bottom. And there are still other compositions beyond these three categories.

Toyota confirmed this multi-tiered approach even back in 2023.

“We will need various options for batteries, just like we have different variations of engines,” said Takero Kato, president of Toyota BEV Factory. “It is important to offer battery solutions compatible with a variety of models and customer needs.”

Given these realities, solid-state batteries are likely to be a game-changer in the sense that they will create a more stratified BEV market with the options for very different budgets and driving ranges, rather than curing all EV owners from range anxiety.

Recent Posts

All PostsAlloy

January 30, 2026

Peter Hughes

January 29, 2026

January 29, 2026

Leave a Reply