BYD Keeps Rising

November 14, 2025

Jay RameyBYD eclipsed Tesla in Europe as part of a larger wave of Chinese brands in 2025, and it's not just EVs that are making rapid progress.

Tesla’s opening of a factory just outside of Berlin in March 2022 may have seemed like a coup for the American EV maker, with Germany’s auto industry at the time widely seen as fretting and seeking to copy Tesla’s recipe.

It’s now a different era in Europe, with Tesla’s sales having been eclipsed by China’s BYD in a seemingly short span of time.

The Chinese automaker, which has been on a global expansion spree for the past few years, outsold Tesla in the EU bloc in April of this year and went on to top its sales in the UK this October, completing the sweep in a seemingly short time.

BYD had seen year-on-year growth of over 225% in Europe as of late summer, while Tesla has faced rapidly shrinking market share in many countries, with some of the steepest drops seen in Germany.

“This is a watershed moment for Europe’s car market, particularly when you consider that Tesla has led the European BEV market for years, while BYD only officially began operations beyond Norway and the Netherlands in late 2022,” Felipe Munoz, Global Analyst at JATO Dynamics, said earlier this year.

BYD isn’t the only Chinese automaker making inroads in Europe. Several brands from the Middle Kingdom saw gains of over 100% over the past 18 months. And they’re not offering solely EVs.

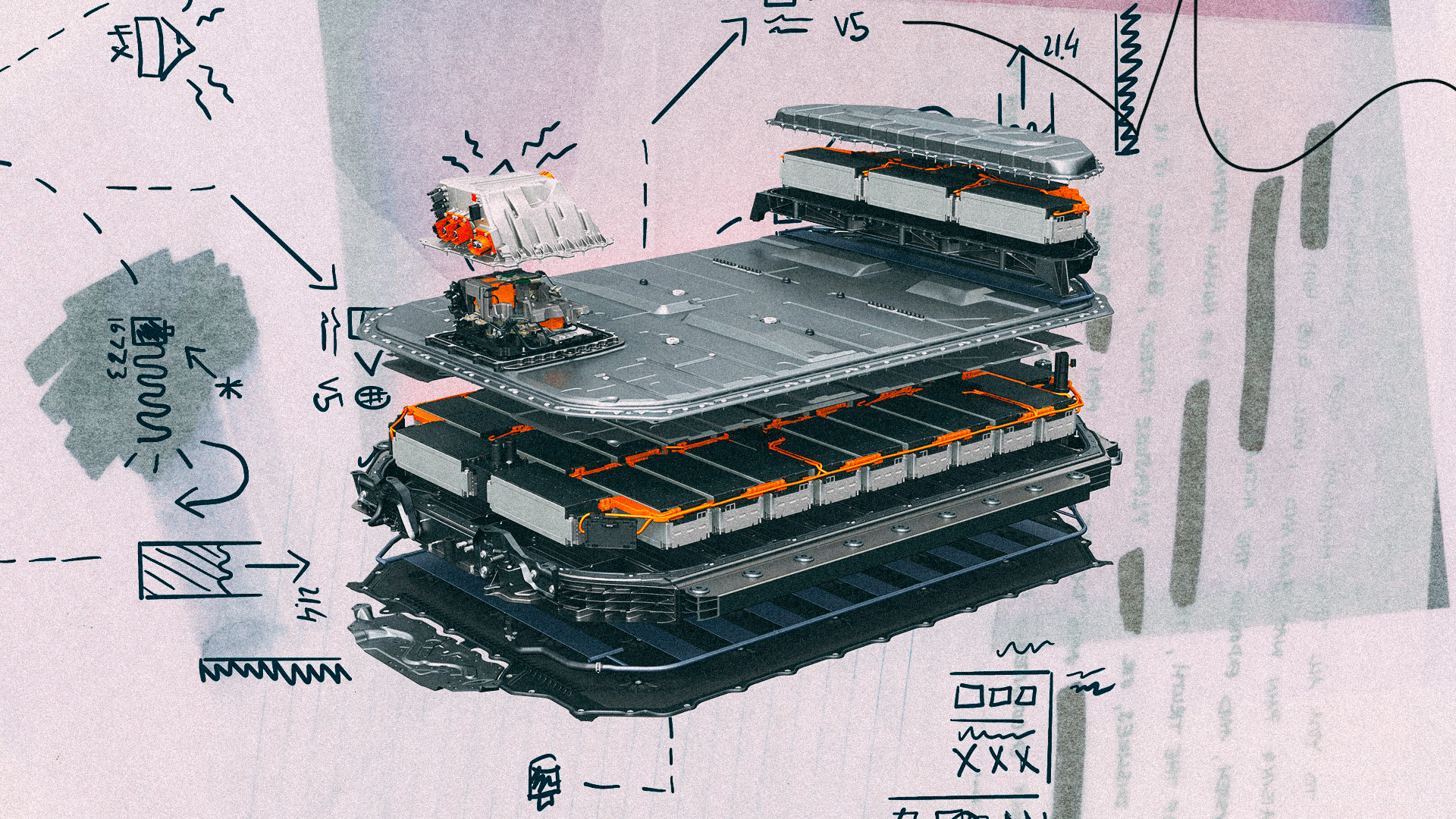

“China is not only the world leader in BEVs; its automakers are global leaders in plug-in hybrid vehicles too,” Munoz added. “To gain traction in Europe, its carmakers have responded to the threat posed by tariffs by focusing on other powertrains, such as plug-in hybrids, to maintain the momentum behind their global expansion plans.”

MG, purchased along with Rover by Chinese automakers nearly 20 years ago, is now a major player in the UK and Europe at large, offering EVs along with ICE models and PHEVs. And it has easily led sales among Chinese brands for the past few years, having been in Europe the longest.

With a plant in Hungary and a quickly growing dealership network, BYD has leapfrogged perennial best-sellers in several segments, focusing on affordable EVs like the Dolphin Surf and the Seal U.

Xpeng has seen major gains over the past year as well, while further upmarket Nio has even started building a series of battery swap stations for its luxury EVs.

Leapmotor, having been brought to Europe with Stellantis’ help, has offered affordable city cars and SUVs alike, with a sharp spike in interest over the past two years.

Over the same period, Tesla has seen dramatic drops in demand in several key markets, especially Germany.

While some of Tesla’s decline can certainly be linked to Elon Musk’s political meddling in far-right German politics, a somewhat overlooked factor is just how Tesla’s lineup has aged on the shelf with largely cosmetic updates, making it an outlier in Europe’s ultra-competitive EV market.

Tesla relies almost exclusively on sales of the Model 3 and Model Y, which debuted seven and five years ago, respectively, and which have been unchanged save cosmetic updates or the launches of decontented versions since. This places them among the oldest EVs sold in Europe, not counting even older offerings like the Model S and Model X.

Another major factor, of course, has been Chinese automakers’ ability to field models in segments well below Tesla in size and price, with European EV makers also having struggled to churn out affordable models quickly enough.

The BYD Dolphin Surf, in particular, has been the poster child of the brand’s offensive in Europe, with a starting price of just £18,500 ($24,435) in the UK. That makes it one of the more affordable EVs on the menu, offering up to 265 miles of range depending on battery size.

Just how large of a share BEVs command in some European markets like the UK has also worked to the advantage of Chinese automakers. For 2025, BEVs are expected to account for just over 23% of all car sales in the UK, and the upward trend isn’t expected to stop anytime soon.

“For 2026, the overall market is expected to reach 2,032 million units, a moderate improvement on the previous outlook, with the BEV outlook maintained at 28.2%,” the UK’s Society of Motor Manufacturers & Traders (SMMT) recently noted.

But it’s not just EVs from Chinese brands that have made quick gains against the familiar cast of European marques. Chery’s Jaecoo 7 SUV, a compact crossover sold in ICE and PHEV flavors, has reached the top 6 spot among all vehicles sold in the UK in October.

“The PHEV segment saw a notable development, as volumes from Chinese players increased by 546% year on year, from 1,493 units in April 2024 to 9,649 units in April 2025, meaning Chinese car brands now account for almost 10% of the total number of PHEVs registered in Europe,” JATO dynamics noted earlier this year.

Taken together, these factors tend to favor continued growth by Chinese brands in the EU and the UK.

But I wouldn’t hold my breath waiting for any of them to land stateside anytime soon, with the past two administrations having enacted measures to block the appearance of Chinese car brands as well as software in the US.

The most I can hope for is that Europe’s study case inspires domestic automakers to field more affordable EV models stateside. So far, only Volvo and GM have gotten the memo.

Recent Posts

All PostsAlloy

January 30, 2026

Peter Hughes

January 29, 2026

January 29, 2026