Piled High

December 15, 2025

Alex KiersteinWhether the cars getting dusty on dealer lots represent an opportunity for deals or an indictment of the economy is a matter of perspective.

Looking over this list of slow-selling new vehicles stacking up at dealerships, there are a few possible reactions. The optimistic one, advanced by the authors of the study (iSeeCars), is that there are deals to be had. 2024 and 2025 vehicles overstocked at dealers, so they’ll surely discount them to move them off the lots. This is certainly true. Go get a deal, if you want.

You could also look at it as an economic indicator in an environment where actual economic data is in shorter than usual supply.

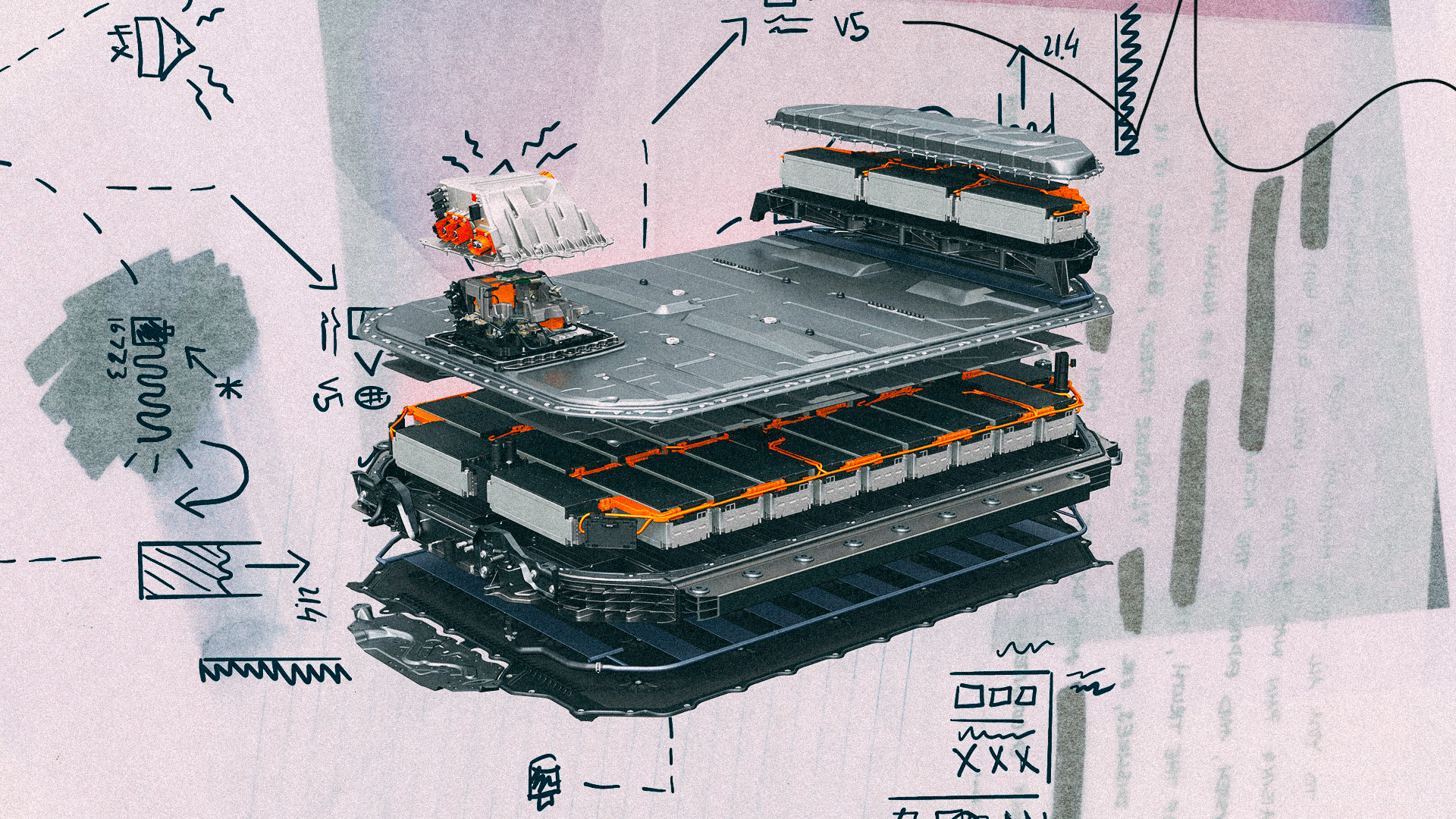

Many of the unsold cars are EVs or hybrids. With the loss of tax credits, these vehicles got significantly more expensive (theoretically) almost instantly. After a rush to nab some before the credits went away, there’s been some understandable consumer hesitation. But many manufacturers are offering incentives that match or exceed the federal tax credits, so it doesn’t completely explain why, for example, the BMW i4 leads the pack in EV inventory left on lots. The lease incentives right now match what they were before the tax credits expired. And BMW is throwing $7,500 on the hood and 0.9% APR financing for those that buy.

That leaves a couple of other possibilities. One is that the products simply aren’t competitive in their segments. The Dodge Hornet PHEV has, according to the study, 82% of its 2024 model year inventory still sitting on lots—the most of any vehicle in America. That is a remarkable indictment of a product; there’s no other way to read that. The Hornet PHEV is not a vehicle consumers want, and they’re buying, it seems, almost anything else.

There’s broad consensus among reviewers and analysts that the Hornet is aimed at a segment that really doesn’t exist. It’s smaller and sportier than its rivals, but the rivals are winning out. The PHEV adds cost, complexity, and an uncompelling advantage in sportiness over its non-PHEV counterpart. It’s a product that simply misses its target audience’s requirements entirely. Not to mention that there reliability concerns for the more complex PHEV, or that the regular Hornet which hasn’t built a positive reputation on its own merits.

But there’s one thing outside of Stellantis’ control: the overall economy. Consumer confidence. And remember, these aren’t raw overall sales numbers, they’re inventory percentages. No dealer or manufacturer wants their cars sitting around. They all factored in expected demand and hoped for a normal turnaround time considering the segment. These are cars that are significantly underperforming, and the common factor seems to be that few car buyers are willing to spend money on a car right now unless they have to.

In a healthy economy, some of these products would still have high inventory amounts. Automakers make bad bets, get backed into a corner, somehow selling a vehicle approved under circumstances that had changed drastically by the time the product made it to market. But also, I have to think that most of these cars would would get closer to their realistic inventory levels in a healthier economic situation.

Recent Posts

All PostsAlloy

January 30, 2026

Peter Hughes

January 29, 2026

January 29, 2026

Leave a Reply